What Is a Demand Deposit Account DDA?

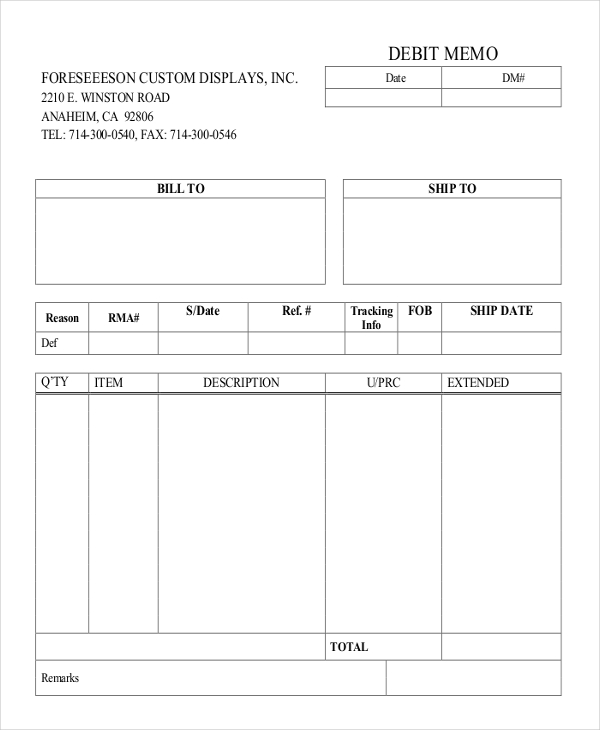

In business-to-business transactions, a debit memo is an adjustment procedure following an inadvertent under-billing of goods or services purchased a customer. The memos typically are shown on bank customers‘ monthly bank statements; the debit memorandum is noted by a negative sign next to the charge. While most DDAs allow you to get your money whenever you want, some accounts may require you to give up to seven days’ notice. “Demand deposit account” may sound mysterious, but a DDA is really just another term for an ordinary checking account. Just note that many banks still impose a monthly withdrawal limit, despite Federal Reserve changes, so you may wind up getting hit with fees if you make frequent withdrawals. You are now leaving the SoFi website and entering a third-party website.

What Is a Demand Deposit in Economics?

- You get the benefit of having a debit card and checks at your disposal, and you earn higher interest than you would with a typical checking account.

- A demand deposit account is a type of bank account that provides 24/7 access to your money.

- Also, consider whether the bank offers any extra incentives, such as interest on checking or rewards for debit card purchases.

- Depending on the bank and type of account you opened, you should receive a debit or ATM card within a few business days.

- In other words, checking accounts, savings accounts, and money market accounts are all considered DDA account types.

You can fund your DDA directly with transfers from other accounts, check deposits (mobile, in-person, or ATM), or cash deposits. • Can earn interest, like a high-yield checking account, depending on the financial institution. Banks have their own internal policies that determine what items get coded as a „force pay.“ One common use of force pay items by a bank involves the cashing of checks drawn from an account at that bank. For example, John writes a check off his Main Street Bank account for $25 to Emily. When Main Street Bank cashes that check for Emily, they use a force pay code on the $25 transaction from John’s account.

Checks Drawn from Bank

If your account does not specify where the money came from, it is simply because the transaction still needs to complete. However if you don’t recognize the transaction, please call your bank immediately to inquire further. The offers that appear on this site are from companies that compensate us. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Amazing Belkin Power Bank For 2024

This makes the main difference between NOW accounts and demand deposit checking accounts the amount of time you must notify the financial institution before a withdrawal. These days, NOW accounts are very rare, likely because they offer no obvious benefits over a demand deposit checking account. One common type of demand deposit account is a checking account that allows you to withdraw funds whenever you’d like simply by making a purchase.

You should, however, be aware of how FDIC insurance protection limits apply when you have multiple accounts at the same bank. A NOW account is a hybrid between a regular DDA (checking) account and a savings account . NOW accounts are checking accounts that pay a higher interest rate than normal, however you may need to provide a notice to your bank or credit union before you withdraw the money. In some cases, this notice period may be as high as 7 days, but this is rarely enforced. Most Americans have one or more time deposit accounts in the form of a checking account, savings account or money market account. These accounts are highly liquid, making them useful for your emergency fund as well as for managing your day-to-day finances.

Interest is an important thing distinguishing demand deposits from term deposits. Term deposits offer interest rates that are generally higher than DDAs’—much closer to prevailing market rates. Demand deposit accounts are designed for on-demand access to your funds.

To truly protect DDAs in the digital age, financial institutions need a partner that can provide cutting-edge technology, extensive data sources, and a deep understanding of the evolving fraud landscape. An overdraft occurs when you spend more money than what is available in your account. In these cases, the bank may charge you fees or decline the transaction, depending on their overdraft policy. The reasons a debit memorandum may be issued relate to bank fees, incorrectly prepared invoices where the amount owed should be greater, and rectifying accidental positive balances in an account.

Depending on the financial institution, demand deposit accounts may come with their own unique features, including interest, fees or minimum balance requirements. Even though the Federal Reserve has eliminated the six withdrawal limit requirement, savings accounts still do not technically qualify as a demand deposit. One of the key features of a DDA dda debit memo is that it offers a high level of liquidity. This means that account holders can easily convert their funds into cash. With a DDA, you can make withdrawals using methods such as checks, ATMs, electronic funds transfers (EFTs), and debit cards. Your DDA balance typically remains in a checking account, which is more accessible than a savings account.

These accounts also usually pay little to no interest – so if you’re keen to make passive income, it may be wise to look at other options like a savings account or investing in the stock market. You can request joint ownership of a DDA, too, meaning they can work well for family finance tracking. While savings accounts at big banks typically earn rock-bottom yields, anyone seeking significantly higher rates will often find them at online banks. By opening a DDA, you gain the ability to easily deposit and withdraw funds using methods such as checks, ATMs, electronic transfers, and debit cards. This accessibility allows for convenient payment options and ensures that your money remains highly liquid. DDA accounts in online banking have revolutionized how individuals and businesses manage their finances.

A demand deposit is a type of deposit that lets you withdraw your money—at any time, for any reason—without having to notify your bank. Not sure if a demand deposit account is the best place to keep your money? Claire is a senior editor at Newsweek focused on credit cards, loans and banking.