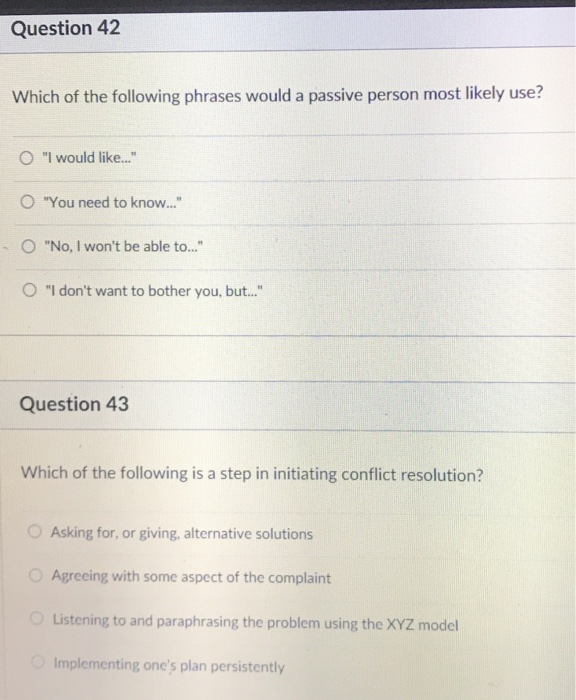

FHA versus Conventional Financing: Which is Much better?

There are several apps and you may pathways to getting for the property sector. For very first-go out homeowners particularly, two types of lowest advance payment money try FHA and Traditional funds. Your Lender at EPM can help you bring a much deeper browse and decide and that mortgage is right for you. However, we also want to take some well-known questions and you may put out of the pros and cons regarding both particular mortgage loans, for finding a head start to your facts just what lending standards is actually, and you may which type of mortgage might fit your means top.

What’s the Difference in FHA and you can Antique Loans?

FHA represents Government Property Administration. And FHA financing is supported by the government. The new FHA guarantees this type of home loans and are also offered owing to FHA-approved loan providers on All of us. This might be a beneficial starting place to have earliest-time homebuyers that simply don’t possess an enormous deposit readily available or have a lesser credit history.

Conventional Mortgage brokers was originated and you will serviced by the individual lenders, financial institutions, and borrowing from the bank unions. Of numerous lenders who bring antique funds will also bring regulators-insured financing. If you have a more powerful credit history otherwise enjoys conserved a 20% advance payment before applying for your loan, you can qualify for a conventional mortgage.

How much does a downpayment toward an effective FHA compared to Conventional Financing Lookup Particularly?

Essentially you will spend a step three.5% downpayment towards an enthusiastic FHA financing. When you have a lowered credit rating or personal debt to help you money-ratio, that will improve in order to 10%

Traditional funds want good 20% deposit. If you don’t have 20% to put down, you must get PMI ( Individual mortgage insurance policies) plus the premium you will mean you find yourself using way more from inside the tomorrow. Get a hold of our very own earlier report on PMI for more information

What Ought i Learn about My personal Credit score and you will Mortgage loans?

Having an FHA Loan, the FICO score can sometimes be regarding the reduced 500s, but lenders may need you to definitely make that upwards large first just before they will approve your loan. In addition will have to consider specific anything else outside of the credit score by yourself, like payment record and debt-to-income ratio. When you yourself have had a case of bankruptcy previously, a keen FHA loan would be smoother around than an effective traditional financing. The lower your credit score, the better brand new questioned advance payment was.

With Conventional Finance, you would like the absolute minimum credit score regarding 620, however, again, due to the fact pandemic, of several lenders would like to force men and women standards right up. A top credit history could also be helpful decrease your rates of interest.

Think about Financial Insurance coverage to your an FHA otherwise Old-fashioned Financing?

FHA Money try covered of the Government Construction Authority as well Augusta installment loans as your up-front home loan superior are step 1.75% of loan. The fresh new FHA will get this type of superior through to the fresh closure of your house, but you’ll obtain it added to all round cost of their financial and you may pay inside it for the life of your mortgage. Additionally, you will afford the FHA a yearly Personal Home loan superior your lender allows you to calculate according to research by the size of mortgage, the amount you place down, and value of your home.

Old-fashioned loans offer PMI ( Private Mortgage Insurance policies) and you can spend the money for superior for at least sixty days towards the a 30-year home loan. For those who have an excellent fifteen-seasons financial- once you have paid off approximately twenty two% of one’s value of the loan, the borrowed funds costs can be stop.

Now that you’ve got a summary and are also equipped with some pointers to find the basketball moving, the leading lenders from the EPM would love to support you in finding away what mortgage is perfect for your personal demands. We have been here to answer the questions you have, and get your come on the path to homeownership with full confidence.