Is Flex Finance Convenient? Exactly what are the Advantages and disadvantages of Fold Loans?

When you yourself have pulled Bend financing within one point during the time; in the event that expected be it that loan, they let you know that it is not that loan. In order to a the quantity, it is an enthusiastic unsecured borrowing providing. When we speak about unsecured, this means you never need build anything while the a beneficial make sure. A regular financing need a world be certain that. Eg, you will be required to prove that you can pay contained in this a given months. Normally, financial institutions would give fund for those who are employed as they know off deducting the money about salaries head regarding the financial institution.

Just how long does it decide to try feel approved and also for your so you can withdraw?

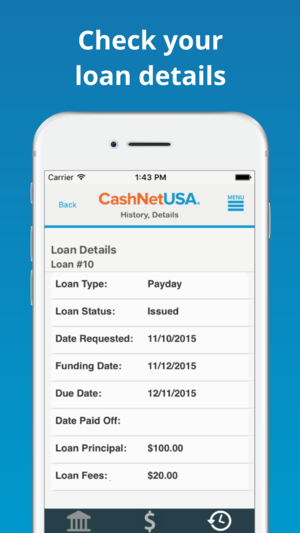

The best part with bend finance is the fact shortly after taken out, you can achieve withdraw people amount inside an extremely brief time. Including, you’ve just applied for a curve financing. The lending company will use any kind of offered ways to look at the creditworthiness. If for example the creditworthiness is up to the high quality, then your financial will send extent questioned into your age-wallet. This is exactly why as to the reasons of several believe it functions a great deal more such playing cards in lieu of average funds.

Just like the flex financing of any count which was questioned could have been recognized, canned and you may delivered to your own elizabeth-bag, the funds might be ready getting withdrawal. The best part having fold loan would be the fact I am able to get a short while, a couple of hours plus seconds whenever you are an extremely creditworthy consumer. Fold loans was unsecured borrowing from the bank however they are some unlike a credit line supplied by private banks. Really banks carry out offer borrowing from the bank simply because youre certainly clients and this their money are usually channeled from the banking institutions.

What exactly do the might accrue off providing a flex financing?

Its a direct substitute for their quick monetary requires. The big banking institutions will not serve you focus during an economic emergency. Every day life is full of concerns therefore has reached a spot where you need particular quick cash. Huge finance companies often reject such as for example a remind demand because their loans manage take time to be canned. Really the only readily available and you will willing supply of loans regarding Fold financing. Bend financing will always take the risk of credit you particular amount instead of requesting collateral shelter. That’s one of the large advantages of Fold funds.

Flex loans do offer a large amount depending on your borrowing rating

There’s no restriction to flex fund. Although not, their maximum relies upon the fico scores. If you were credit from other financing organizations therefore had been investing the fund timely, then there are higher chances that your particular creditworthiness try epic. Therefore, you can obtain up to $4,000. This might be other regarding loans. Loans will only look at your paycheck or you inflow an https://availableloan.net/loans/loans-for-pensioners/ outflow out-of fund on the and you may from the account.

Quick acceptance, operating and you may withdrawal

It will require an extremely short time getting a fold financing in order to feel canned. Normally, you are going to discovered feedback one to lets you know that financing could have been accepted or not. In the place of banks where your own approval may take days and you may appear bad, Flex loan lenders will let you discover whether you be considered otherwise perhaps not within a few minutes otherwise few moments. For those who qualify for they, then you will found a message one claims, their Fold mortgage request might have been gotten and you may recognized. Some other content will come stating that it could be processed within a few momemts. Real for the message, your Bend financing would-be recognized otherwise disapproved within seconds.

Its an open-prevent credit line

Flex financing isnt a form of loan that will deduct your own income or income from the bank account. If so, it is an unbarred-ended type of mortgage. What does open-end mode, it indicates that one can repay or provider Bend mortgage off any provide and you may from accepted methods of payments. If that’s the case, you don’t need to care about their paycheck becoming subtracted and you can so much more difficulties getting composed in the act. Whenever we compare this together with other financing, you are going to realize they are reliable, versatile plus friendlier to good the amount.

Detachment anytime off almost any mode

If your Fold financing could have been recognized, you get to withdraw actually within seconds adopting the financing was in fact channeled with the age-handbag. So what does that mean? It lets you know they are perfect while in the financial emergencies. You happen to be broke in the 8 good.m. and you will rich in the following hr.

Setbacks with the Fold Loans

One can finish purchasing a lot more throughout repayment. Flex finance try easier in the event the paid down in windows out-of costs that have been applied. However, because they’re really smoother, you can wind up investing more than he/she had requested. All the smoother material boasts a price. This means that, Bend finance is tied together with exorbitant hobbies and you may costs. Particularly fees commonly aimed at pissing you away from nonetheless is actually intended for doing well worth for cash you may have lent. For most, its worth every penny as Bend money try much easier and you may affordable in the event the lent into the a small amount.

Flex money was financially risky

Did you know incapacity to spend right back Flex loans you are going to lead to debt collectors being delivered to their doorsteps almost every times? Regarding the bad issues, brand new defaulters out-of Flex finance was indeed compelled to market the services and other property in order to observe that the loan provides started qualities completely. From the that, failure to blow the flex loan will certainly connect with your own borrowing from the bank limitations plus creditworthiness. Failure to invest timely attract penalties as the from the affecting their credit constraints.