Mastering Strategies for Pocket Option Trading

Mastering Strategies for Pocket Option Trading

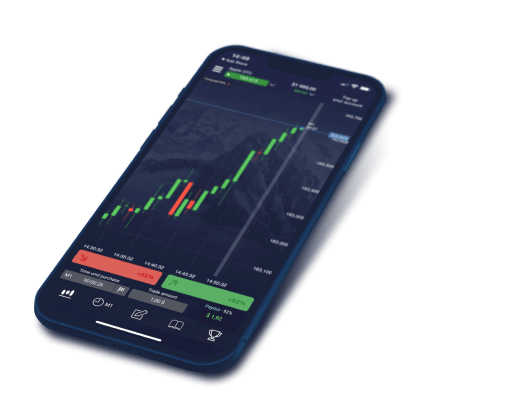

In recent years, the world of online trading has gained immense popularity, attracting both beginners and seasoned traders. One platform that stands out in this bustling marketplace is Pocket Option Trading Pocket Option trading. Offering a user-friendly interface, a plethora of trading options, and a range of educational resources, Pocket Option has become a go-to choice for many. This article delves into strategies and techniques that can enhance your effectiveness in trading on this platform.

Understanding the Basics of Pocket Option Trading

The first step in mastering Pocket Option trading is developing a sound understanding of the platform itself. What makes Pocket Option unique? The platform allows users to trade a variety of assets, including forex, cryptocurrencies, commodities, and stocks. Users benefit from features such as demo accounts, which provide a risk-free opportunity to practice trading before investing real money.

Moreover, the platform offers various trading types, including binary options and high/low trades. Familiarize yourself with these options, as they will be crucial in determining your trading strategy. Understanding when to execute trades, how to manage risk, and the importance of timing can make a significant difference in your trading success.

Choosing the Right Trading Strategy

The next step is to choose a trading strategy that suits your risk tolerance, trading style, and financial goals. Here are some popular strategies employed by successful Pocket Option traders:

1. Trend Following Strategy

One of the most common trading strategies is the trend-following approach. This method involves identifying the prevailing market direction and trading in that direction. For instance, if you notice that an asset’s price is consistently rising, you would consider entering a buy position. Utilize various indicators, such as moving averages and trend lines, to help determine the trends.

2. Reversal Trading

Reversal trading seeks to identify potential turning points in the market. Traders will watch for significant price movements that may signal a change in direction. This strategy can be particularly lucrative but requires a keen understanding of market indicators and patterns to avoid false signals.

3. News Trading

Keeping an eye on economic news and events is critical in Pocket Option trading. Major news releases often result in increased volatility and can significantly affect asset prices. News trading involves making trades based on anticipated market reactions to news events. However, this strategy requires quick decision-making skills and a clear understanding of how different news impacts the markets.

Effective Risk Management

No trading strategy is complete without robust risk management. Protecting your trading capital should be your top priority. Here are a few risk management techniques to consider:

1. Set Stop-Loss Orders

Utilizing stop-loss orders is one of the simplest ways to manage risk. A stop-loss order automatically closes your position at a predetermined price level, helping to limit potential losses. Determine your acceptable loss level before entering a trade and ensure that your stop-loss is properly set.

2. Diversify Your Portfolio

Diversification involves spreading your investments across different assets to reduce risk. Avoid putting all your funds into a single trade or asset. By diversifying, you can mitigate potential losses in one area by benefiting from others.

3. Use Proper Position Sizing

Position sizing is another crucial aspect of risk management. For every trade, determine the percentage of your capital that you are willing to risk. Effective position sizing helps ensure that no single loss will wipe out your trading account.

The Psychology of Trading

While strategies and models are vital elements of successful trading, psychology plays a significant role, too. Emotions such as fear and greed can cloud judgment and lead to poor decision-making. It’s essential to stay disciplined and stick to your trading plan. Here are some tips for maintaining the right mindset:

1. Keep a Trading Journal

Documenting your trades helps you track your performance and identify recurring mistakes. A trading journal allows you to reflect on your emotions during trades, enabling you to make necessary adjustments for future trades.

2. Accept Losses

Losses are an inherent part of trading. Accepting them and learning from your mistakes can help you become a better trader. Instead of dwelling on a loss, analyze what went wrong and how you can improve.

3. Stay Informed

Continuing education is key in the trading arena. Stay informed about market trends, economic changes, and new trading strategies by engaging with community forums, webinars, and tutorials. The more you know, the better equipped you are to make informed decisions.

Conclusion

In conclusion, Pocket Option trading can be a rewarding endeavor when approached with the right strategies and a disciplined mindset. By mastering fundamental concepts, choosing suitable trading strategies, managing risks effectively, and cultivating a strong psychological framework, you can increase your chances of success in this fast-paced market. Whether you’re a novice or an experienced trader, committing yourself to continuous learning and adaptation will help you navigate the ever-evolving landscape of online trading.