Solution The way to get Security From your home

In terms of financial support your house, you to definitely proportions will not match all. And while antique choices eg finance, domestic security credit lines (HELOCS), refinancing, and you will opposite mortgages can perhaps work better for many people, the current increase out-of loan solutions such as for example household equity dealers and you can other growing platforms have made it obvious that there surely is an evergrowing demand for other available choices. Find out about alternative the way to get equity from your domestic, in order to make a informed decision.

Traditional Choice: Positives and negatives

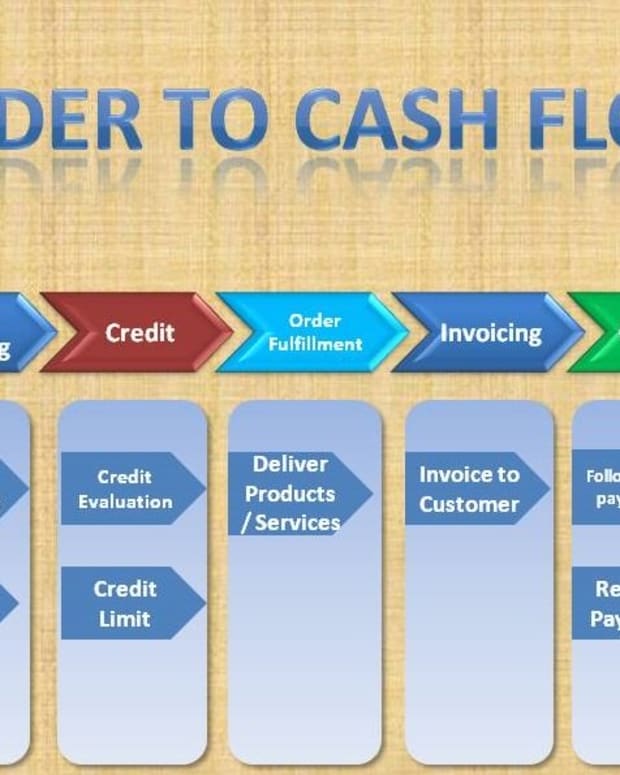

Money, HELOCs, refinancing, and opposite mortgage loans could all be attractive ways to tap into the fresh collateral you’ve collected of your house. Although not, you will find tend to as much downsides and there’s masters – so it is vital that you comprehend the benefits and drawbacks of any to understand as to why specific people are searching for investment possibilities. Comprehend the graph less than to easily compare mortgage choices, next read on for more details on each.

House Security Fund

Property guarantee financing is one of the most common ways one to homeowners availability its collateral. One can find gurus, including a foreseeable payment per month considering the loan’s fixed attract speed, additionally the fact that you’re going to get this new guarantee in a single swelling share fee. Hence, property collateral financing normally is practical if you’re looking in order to security the cost of a remodelling venture or high one-out of expense. In addition to, your own focus payments can be tax-allowable while utilizing the money for home improvements.

Why identify a home guarantee financing option? Several reasons: Basic, you’ll need to pay off the mortgage along with your own regular mortgage payments. While your own borrowing from the bank try quicker-than-advanced level (significantly less than 680), you will possibly not be also accepted getting a property collateral loan. Finally installment loans in Hudson PA with bad credit, the application form techniques are going to be invasive, cumbersome, and you may taxing.

Home Guarantee Personal lines of credit (HELOC)

HELOCs, a familiar alternative to property security loan, provide quick and easy entry to loans in the event that you you desire him or her. And while your typically you prefer a minimum credit score away from 680 to help you qualify for an effective HELOC, it can indeed help you alter your score throughout the years. In addition to this, you’re in a position to take pleasure in income tax masters – deductions to $a hundred,000. As the it’s a line of credit, there’s no appeal owed if you do not take out money, and take-out doing you want until you hit their restriction.

But with that it self-reliance happens the potential for more loans. Instance, if you are planning for action to pay off playing cards with highest interest rates, you can finish accumulating far more charges. That it in reality takes place many times that it is recognized to loan providers once the reloading .

Some other significant drawback which can prompt people to get good HELOC option ’s the imbalance and you will unpredictability which comes along with this choice, due to the fact variability from inside the cost can result in changing debts. The financial may also frost your HELOC at any time – or lower your borrowing limit – in the eventuality of a fall on your credit score otherwise domestic well worth.

Learn how prominent its to possess people as if you to utilize for home loans and HELOCs, in our 2021 Resident Declaration.

Cash-aside Re-finance

You to alternative to a home security financing is an earnings-away re-finance. One of the greatest benefits from a finances-out refinance is that you can secure a lowered interest in your home loan, which means that straight down monthly obligations and much more dollars to pay for most other expenditures. Otherwise, if you can generate high payments, a beneficial refinance is a good way to shorten the financial.

Definitely, refinancing has its own selection of challenges. While the you will be generally settling your current home loan with a new one, you happen to be stretching their mortgage schedule and you are saddled with the same charge you looked after to begin with: software, closure, and you may origination costs, name insurance policies, and maybe an assessment.

Overall, you can expect to shell out anywhere between one or two and you will half a dozen per cent of your full count your acquire, according to particular bank. However-named no-cost refinances can be inaccurate, as the you will probably has actually a higher level to pay. In the event your count you are borrowing try more than 80% of the home’s well worth, you will likely need to pay for individual home loan insurance policies (PMI) .

Clearing the newest difficulties from software and you may degree may cause deceased concludes for some homeowners who possess blemishes on the credit score otherwise whoever ratings just are not high enough; most loan providers need a credit rating with a minimum of 620. Mentioned are a number of the causes property owners will see by themselves looking to a substitute for a finances-aside re-finance.

Contrary Mortgage

Without monthly payments, an other home loan will likely be perfect for elderly residents looking more cash throughout the senior years; a recent estimate from the Federal Reverse Mortgage lenders Relationship discover that elderly people had $seven.54 trillion tied up in real estate equity. Yet not, you may be still accountable for the brand new fee from insurance rates and you may taxes, and want to remain in the house into longevity of the loan. Opposite mortgages likewise have an era element 62+, and therefore laws and regulations it just like the a practical option for of many.

There is a lot to adopt when examining antique and you will solution a means to access your house security. The next publication helps you navigate for each and every option even more.

Finding an option? Enter the Household Equity Funding

A newer replacement for house equity funds try home collateral assets. The advantages of a house equity capital, instance Hometap also offers , or a shared enjoy arrangement, are numerous. These types of traders give you near-fast access to your collateral you’ve built in your house from inside the change to have a share of its upcoming well worth. At the conclusion of new investment’s productive period (which utilizes the business), your settle new money by buying it having deals, refinancing, or attempting to sell your house.

That have Hometap, in addition to an easy and smooth application techniques and you will novel qualification requirements that’s commonly alot more comprehensive than regarding lenders, you have one-point from contact regarding money sense. Possibly the vital distinction would be the fact instead of these types of more conventional channels, there are no monthly premiums otherwise notice to be concerned about on the finest of your mortgage payments, to reach your monetary requires faster. If you’re looking to alternative the way to get guarantee out of your house, working with a home guarantee individual would be really worth exploring.

Is an effective Hometap Resource suitable house equity mortgage alternative for both you and your possessions? Take our five-time test to determine.

We carry out the best to make certain that everything inside the this information is once the perfect as possible by the fresh new day its penned, but anything change rapidly both. Hometap does not endorse otherwise screen people connected websites. Private factors differ, thus consult with your individual funds, tax otherwise legal professional to see which is practical to you personally.